The weeks between the end of February to the end of June the market sent many mixed signals. The longest bull market in history, with a full 12 year stock market rally, was seemingly followed by the shortest bear market in history, only one month of declining stock prices. Now there remains a debate amongst the investors – can such a long bull market truly be followed by such a short bear market? Although the effects of the crash will have both short term and long term affects, is the v-shaped recovery a one-time anomaly or waiting for another crash?

When trying to predict the market, investors use previous events with similar patterns to see what will most likely happen also known as technical analysis. This method works well since patterns in the market have a high chance of repeating themselves. In previous bear markets – Dotcom Bubble and Great

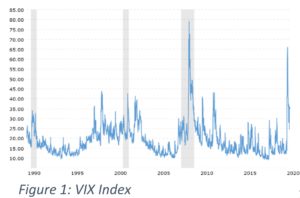

Recession, for example – all lasted many months and the recovery was gradual. The COVID-induced recession is quite the opposite, it only lasted a month and the recovery took just as long. In terms of using technical analysis, this recession is unpredictable. Additionally, the general uncertainty tracker for the stock market, called the VIX (Volatility Index), hit a high of 66 on March 16 and was around 30 by the end of June. Normally the VIX is around 20, which means that people are very uncertain about the market. Potentially because a new second wave of COVID cases could bring the market to its knees again.

Another element that remains uncertain is if the stock market is truly reflecting the actual market. With thousands of people getting the virus and dying every day, over 10 percent of the workforce remains unemployed, and major companies filing for bankruptcy due to the virus, it seems impossible that the stock market should be ticking up – but it is. Often this can be associated with investor optimism, meaning that people believe that economy will recover quickly. However, polls show that investor optimism is currently at its lowest point since 2015. This makes a very unclear picture about what is driving the market and why it is not reflecting the state of the economy.

Another element that remains uncertain is if the stock market is truly reflecting the actual market. With thousands of people getting the virus and dying every day, over 10 percent of the workforce remains unemployed, and major companies filing for bankruptcy due to the virus, it seems impossible that the stock market should be ticking up – but it is. Often this can be associated with investor optimism, meaning that people believe that economy will recover quickly. However, polls show that investor optimism is currently at its lowest point since 2015. This makes a very unclear picture about what is driving the market and why it is not reflecting the state of the economy.

With such uncertainty in the market, the logical investment approach would be one of great caution. However, that is not what many companies are doing – they are starting to invest aggressively. PNC sold $14B in shares without stating the use of the proceeds. Many companies are filing for IPOs, including Shift4 (FOUR, $345M), Warner Music Group Corp. (WMG, $1.9B), and Vroom Inc. (VRM, $468M). Some companies such as Shift Technologies Inc. and Albertsons decided to go public due to COVID. IPOs generally do not occur in a bear market since companies believe that they will not be able to generate the revenue they want. Additionally, unstable markets keep IPOs away for the same reason since investors are afraid to buy new stocks if there is a fear of them devaluing quickly. Yet, these IPOs were remarkably successful and shows that there are many investors who are confident about the state of the market. On the other hand, there have been no major IPOs – defined as ones larger than $5B or larger – which suggests that larger companies are still warry of exposing themselves to an unstable market.

Another interesting issue within the IPO market is that most of them are being filed by special purpose acquisition companies (SPAC). In April 2020, about 80% of the funds raised for IPOs went to SPACs, compared to 8% in a normal market. These are shell companies that raise money to acquire other companies. Many investors are placing their bets that these SPACs will be able to capitalize on the companies that survive through COVID. However, an interesting development happened when Bill Ackman recently decided to try and raise $6.5B for one of the largest SPAC IPOs ever. This is an interesting since it indicates his optimism for the market since he believes he can find enough investors who are bullish on his SPAC.

Another area that seems to side more strongly with the volatile side is the Mergers and Acquisitions (M&A) sector. Most companies have abandoned their M&A activity due to COVID. For example, SoftBank stopped their $3B offer for WeWork shares. This shows how many companies are still retaining their cash to secure their own company first, and second, are afraid that the market will not be able to price their company fairly and will not raise the amount of money they had anticipated. However, there are some companies who are looking to do M&A. For example, Lululemon announced they wanted to buy Mirror for $500M on June 30th. A larger example is GrubHub’s planned acquisition by Just Eat Takeaway for $7.3B. Also, Uber recently agreed on July 5th to buyout Postmates for $2.65B.

In context of IPOs and M&As, it is important to discuss the huge new barrier that is stopping many companies from doing IPOs – digital operational due diligence (ODD). In the past, companies would be partially valued based on their workspace and work dynamic. However, due to COVID, work has been moved online and preforming these assessments have become exceedingly difficult. Many investors have a difficult time trusting the level that the ODD can be performed. However, as investors have started to accept the virtual roadshows and thereby opening opportunities.

With economic stress pulling companies at the seams, many companies have moved to restructuring to create financial flexibility. For example, Unilever announced it would restructure by combining its Dutch and British offices into one office. This would allow it to run and create new deals more smoothly. Chucky Cheese is another example of a company that is restructuring as part of filing chapter 11 bankruptcy. They had invested in many new locations that were not able to open due to COVID, causing massive losses within the company. Macy’s is laying off about 3,600 employs in an effort to save $365M this year and $630M per year in the future. This restricting will dramatically reduce overhead costs for the organization.

With such a chaotic market, remaining conservative with defensive investing should be the widespread strategy, yet, there are companies that are more comfortable with the economic climate to file for IPOs and M&As. This highlights the polarity between investors about the certainty of the economy’s recovery. While some remain believe that the market still needs fall to before it stabilizes, other optimistic investors believe that much of the recovery has already occurred and the economy will tick up from now.

Originally published in The Observer: https://yuobserver.org/2020/07/market-confusion-on-all-sides/